Last year, Universe Club also held a question-and-answer contest, "Let's pay for Papa Katsu."

Even if it is said that there will be a tax on dad activities or a gift tax will be imposed, there may be many papa girls who are worried about "What should I do specifically?"

Therefore, this time, it is a simulation project that "If you actually pay the dad tax, what kind of procedure should you do?"

-----However, I am not a tax professional myself, and this article is based on my experience of filing tax returns for over 20 years as a sole proprietor. I would appreciate it if you could refer to it as a vague image of what the flow would be like if you actually wanted to file a tax return for your father.

Contents

- 1 What you need is a “declaration form” and a “statement of income and expenditure”

- 2 Self-reported income for Papa-katsu!

- 3 It is the income that is taxed, not the income.

- 4 Things that are only used for dad activities become "expenses"!

- 5 "Revenue" - "Expenses" = "Income"

- 6 "Industry name" can be anything you want, such as "entertainment business" or "freelance"!

What you need is a “declaration form” and a “statement of income and expenditure”

According to the Income Tax Act, you must file a final tax return and pay income tax between February 1th and March 1th of the following year for income generated from January 12st to December 31st of each year. increase.

People who usually work in a company don't have to file a final tax return because their company does a year-end tax adjustment at the end of the year, but they have other side jobs or donate gifts. Recipients must correctly declare and pay taxes on their income.

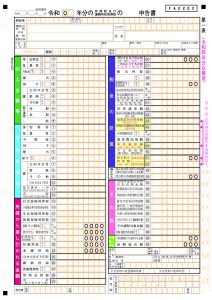

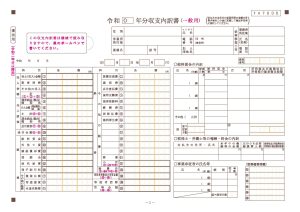

These two documents are what you need! These are the “tax return form” and the “income and expenditure statement” necessary to calculate expenses.

BothhereYou can download it for free on the National Tax Agency website, and you can get it for free at the tax office.

Self-reported income for Papa-katsu!

In the case of a general salary, a "salary statement" etc. is issued, but apart from the case where you work for your father's company and receive a salary, Daddy activity is usually an individual contract. There is no such thing as a contract being exchanged between people or a receipt being written.

There are no documents to prove income, so the income from Papa Katsu is only self-reported by the woman.

Whether you have a regular dad or a regular dad, if you have a total annual income of 110 million yen or more, you will need to declare it, so when you earn income from dad activity, make a note of it frequently. ◎

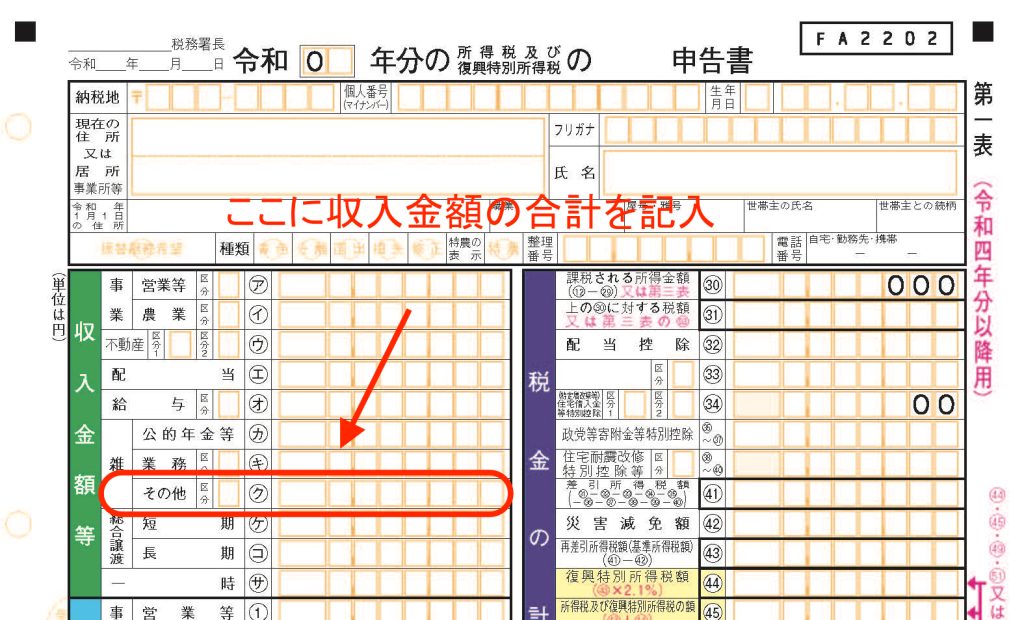

Enter this "income amount" in "miscellaneous income" under "income amount, etc." on the tax return form. (* This time, it will be a simulation as a woman who does not have salary income and has income only for dad activities.)

It is the income that is taxed, not the income.

The most important thing here is that what is taxed is not the above "income amount" but the "income amount" after deducting expenses.

Even if you have an income of 400 million yen a year as a dad, you can deduct expenses from it, and if the "basic deduction" that anyone is exempted from income is 2400 million yen or less, it will be 48 yen. Considering that, if the amount of Papa Katsu's income minus expenses is 48 yen or less, no tax will be imposed, so no tax will be incurred.

Things that are only used for dad activities become "expenses"!

What is worrisome is the items that can be used as "expenses".

When you actually file a tax return, I think it's safe to go to the tax office and fill it out while the staff teaches you, or consult a tax accountant, but if it's something you only use for dad life, it's "expenses" ” should be able to count.

What you need here is an income statement.Originally, the income and expenditure statement has columns for filling in "packaging fare", "travel expenses", "communication expenses", "entertainment entertainment expenses", etc., but there are also blanks where nothing is entered.

If you write down the "costume fee", "beauty fee", "main subject", "material fee", etc. here, you can include them as expenses.

Specifically, the "packaging fee" is, for example, the courier fee and the box fee for giving something to daddy as a gift.

"Travel expenses transportation expenses" is exactly that, but transportation expenses used for dad activities.

"Communication expenses" include telephone charges, Internet usage charges, stamp charges, etc.If you have only one mobile phone and use it for both private and daddy activities, depending on the percentage of actual usage, if it is about 1/3 to 1/2 of the mobile phone fee It is considered an expense.

If you are using a cell phone exclusively for Dad activities, the cell phone bill can be recorded as an expense.

“Entertainment and entertainment expenses” are the price for gifts and tea for daddy.Souvenirs for dating clubs and the price of tea when exchanging information between daddy active girls can also be recorded.

If you use it in your private life, it will be difficult to include it in your expenses, but the clothes, cosplay costumes, underwear, etc. purchased for dad activities are "costumes".

Depakosu purchased for use in dad life is "beauty fee".The cost of the beauty salon where you set your hair before meeting your dad can also be included as a “beauty fee”.

There may be a high possibility that esthetics and cosmetic surgery can be reduced by the "beauty fee", but there is a problem in this area, so there is a possibility that the full amount may not be recognized as an expense in some cases.

If you are unsure, please ask your tax accountant or tax office staff.

"Revenue" - "Expenses" = "Income"

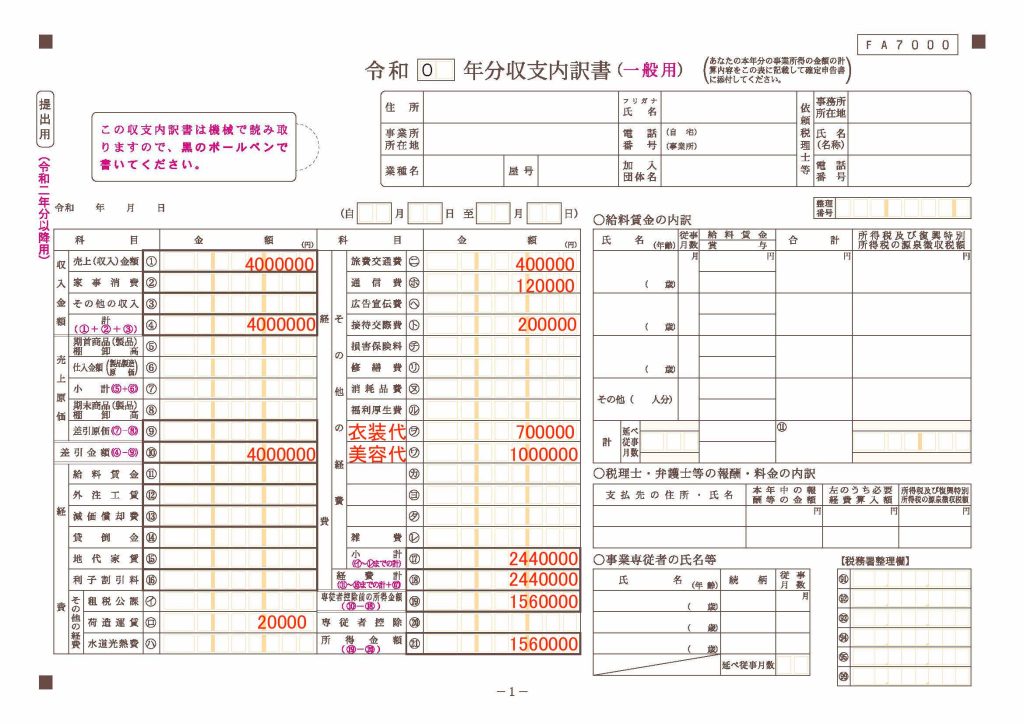

Now let's actually create the document.In order to make it easier to understand, the amount will be roughly assumed.

Papa's income is 400 million yen.

"Packing fare" 2 yen, "Travel expenses" 40 yen, "Communication expenses" 12 yen, "Entertainment expenses" 20 yen, "Costume fee" 70 yen, "Beauty fee" 100 million yen, , enter it in the income statement.

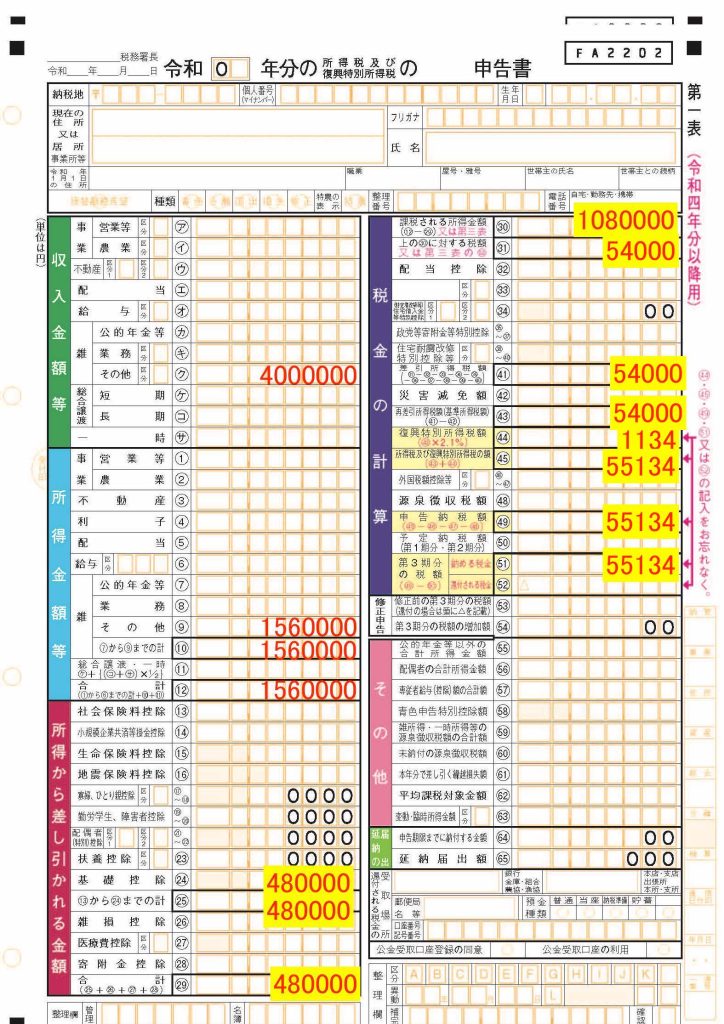

Since the total expenses are 244 million yen, 400 million yen - 244 million yen = 156 million yen, and 156 million yen is "income."If you subtract the basic deduction of 48 yen from there, it will be 108 yen.this108 yen is taxable.

194 yen or lessThe income tax rate is 54000%, so it is XNUMX yen.

special income tax for reconstructionIt costs 2.1% of the income tax amount, so it is 1134 yen.So,The total tax amount is 55134 yenIt will be.

This is what you will see when you write this down on your application form.

The tax amount of 55134 yen can be paid in cash at the counter of the tax office, as well as at convenience stores or by credit card.

"Industry name" can be anything you want, such as "entertainment business" or "freelance"!

Finally, when creating documents, the “industry name” is of concern.

If this can be done as a "model" or "talent", it will be easier to pay for beauty and costume costs, but if you are making a living purely from dad activities, personally, "entertainment business" Is it better?I think.

When I asked my acquaintance, a tax accountant, he said that there is no clear rule for the name of the industry, so "freelance" or "part-time job" would be fine. What is your occupation? What is a freelancer who pays for hairdressing and clothes?" That's what I'm talking about.

When you hear the word “tax,” you may think that it is somewhat difficult, but when you actually try it, you may think that it is surprisingly easy.

This time, it was a rough simulation so that you can understand the flow of creating tax documents, but if you go to the tax office, the tax office staff will teach you kindly and politely, and you can also hire a tax accountant. There are many cases where you can ask for less than 1 yen per month, and it seems that there are cases where you can ask for less than 10 yen even if you throw away only the final tax return.

For those who thought, "Let's pay my dad's tax!", I thought I'd go to the tax office and prepare the documents while listening to them. So it is recommended to go relatively early after February 3th.

If you call the tax office in your jurisdiction and ask them to connect you to the Tax Return Telephone Consultation Center, operators, tax accountants, and staff will be able to help you, so if you are interested, please use it.

(If you are reading this article and are familiar with tax matters, please let me know if there are any mistakes. Thank you.)