If the money you received from your father is more than the minimum living expenses, you need to pay tax, which is the minimum rule for living in Japan.

If you do not pay the tax, there will be restrictions on how you can use the money, and you will feel guilty that you are doing something illegal.

The activity itself is controversial, but it is not illegal.

However, avoiding tax payment is illegal.

Dating clubs are places where adults meet adults, and adults are people who pay taxes.

Ladies and gentlemen, with the correct knowledge, why don't you improve yourself and make your dreams come true with the money you received from your father?

![]() Let's know before you get worried "Papa Live Tax"

Let's know before you get worried "Papa Live Tax"

I don't understand if you suddenly say tax.

Do I have to pay for what I've received so far?

Let's first understand the "papa live tax payment" about the financial support obtained through papa activities.

What would you do if you received $400 a year?

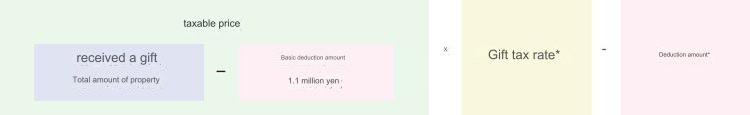

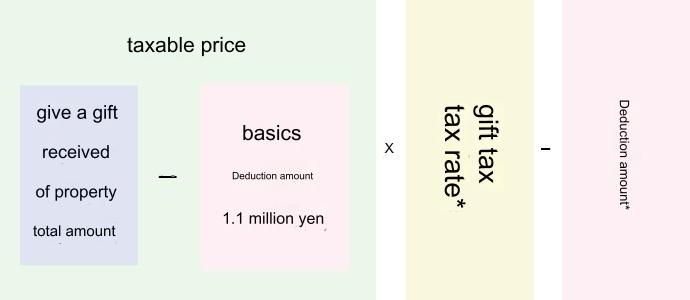

![]() Gift tax calculation method

Gift tax calculation method

Please refer to the table below for the applicable tax rate and deduction amount, which differ depending on the "amount received minus the basic deduction (110 yen)".

| amount received | Taxable price | Tax payment |

| 500,000 Yen | 0 Yen | 0 Yen |

| 1,000,000 Yen | 0 Yen | 0 Yen |

| 1,500,000 Yen | 400,000 Yen | 40,000 Yen |

| 2,000,000 Yen | 900,000 Yen | 90,000 Yen |

| 2,500,000 Yen | 1,400,000 Yen | 140,000 Yen |

| 3,000,000 Yen | 1,900,000 Yen | 190,000 Yen |

| 3,500,000 Yen | 2,400,000 Yen | 260,000 Yen |

| 4,000,000 Yen | 2,900,000 Yen | 335,000 Yen |

| 4,500,000 Yen | 3,400,000 Yen | 430,000 Yen |

| 5,000,000 Yen | 3,900,000 Yen | 530,000 Yen |

| amount received | Taxable price | Tax payment |

| 500,000 Yen | 0 Yen | 0 Yen |

| 1,000,000 Yen | 0 Yen | 0 Yen |

| 1,500,000 Yen | 400,000 Yen | 40,000 Yen |

| 2,000,000 Yen | 900,000 Yen | 90,000 Yen |

| 2,500,000 Yen | 1,400,000 Yen | 140,000 Yen |

| 3,000,000 Yen | 1,900,000 Yen | 190,000 Yen |

| 3,500,000 Yen | 2,400,000 Yen | 260,000 Yen |

| 4,000,000 Yen | 2,900,000 Yen | 335,000 Yen |

| 4,500,000 Yen | 3,400,000 Yen | 430,000 Yen |

| 5,000,000 Yen | 3,900,000 Yen | 530,000 Yen |

If you earn 400 million yen through dad life...

(400 million yen - 110 million yen) x 15% - 10 yen = 33.5 yen

It becomes the calculation formula.

◎ How to calculate the tax amount

*Apply tax rates and deductions by referring to the National Tax Agency's "Gift Tax Quick Calculation Table" for general gift property (general tax rate).

Since 27, the gift tax rate has been divided into "general gift property" and "special gift property" as follows.

<For general gift property> (general tax rate)

| Taxable value after basic deduction | Below 200 yen | Below 400 yen | Below 600 yen | Below 1,000 yen | Below 1,500 yen | Below 3,000 yen | Below 4,500 yen | Over 4,500 million yen |

| tax rate | 10% | 15% | 20% | 30% | 40% | 45% | 50% | 55% |

| Deduction | - | 10 million yen | 25 million yen | 65 million yen | 125 million yen | 175 million yen | 250 million yen | 400 million yen |

| Taxable value after basic deduction | tax rate | Deduction |

| Below 200 yen | 10% | - |

| Below 400 yen | 15% | 10 million yen |

| Below 600 yen | 20% | 25 million yen |

| Below 1,000 yen | 30% | 65 million yen |

| Below 1,500 yen | 40% | 125 million yen |

| Below 3,000 yen | 45% | 175 million yen |

| Below 4,500 yen | 50% | 250 million yen |

| Over 4,500 million yen | 55% | 400 million yen |

It is easy to make a mistake here"I see the applicable tax rate with the amount received"That's a lot of things.

you have to"Amount after deducting the basic deduction amount of 110 million yen"でApplicable tax rateLet's see

I don't understand how to pay taxes.I want you to tell me.

![]() What is a tax return?

What is a tax return?

A tax return is a procedure for calculating and paying taxes on income for the year from January 1st to December 1st.

Income tax

- Calculation target: Income from January 1 to December 1

- Procedure period: From February 2th to March 18th

gift tax

- Calculation target: Income from January 1 to December 1

- Procedure period: From February 2th to March 1th

![]() How to submit a tax return

How to submit a tax return

First of all, there are three ways to submit a final tax return.

- How to declare by e-Tax

- Post

- Bring to tax office

Submit your work in any way you like between February 2st and March 1th.

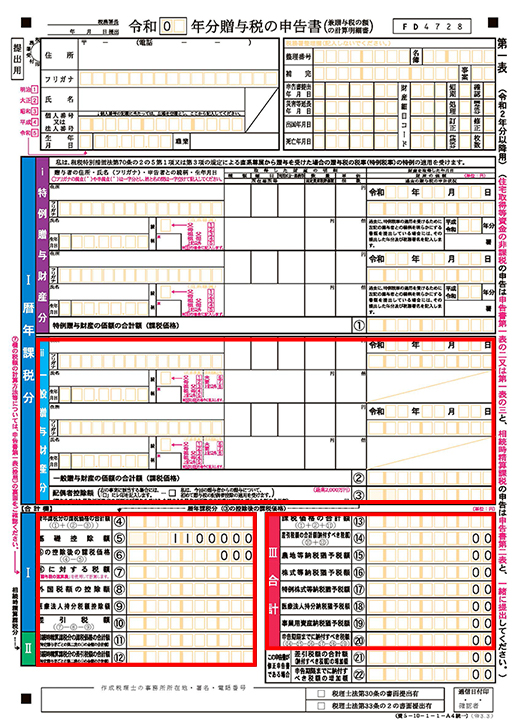

![]() What do you use for your tax return?

What do you use for your tax return?

The format of the tax return varies depending on the type of gift tax.

In the case of dad activity, it is a format called "first table".

Fill in the fields circled in red and submit.

What happens if dad doesn't pay tax?

If the tax audit finds a problem, you will be charged the following taxes:

1. Additional tax for underreporting

2.Additional tax for non-declaration

3. Double additional tax

4. Additional tax for non-payment

5. Late tax

Other possible penalties include lying in a tax audit or being uncooperative in a tax audit.

In the worst case, you may be arrested in the case of malicious methods or large amounts of tax evasion.

What are the pros and cons of paying tax as a dad?

Merit

- You can save money and prepare for emergencies

- Acquiring financial sense and tax saving knowledge

- You will be able to choose how to use your tax money by using the donation system

- Don't be afraid of tax audits

Demerit

If the tax office determines that you are vicious, you will be arrested and become a criminal record.

I think it's safe to say that there are almost no disadvantages compared to the disadvantages of not paying taxes.

What happens if tax evasion is discovered?Are you arrested?

In the worst case, you may be arrested in the case of malicious methods or large amounts of tax evasion.

I have received a lot of money in the past.Is it all taxable?

There are three types of tax statutes of limitations.

If the statute of limitations is 3 years

If you have properly submitted the declaration within the deadline

If the statute of limitations is 5 years

If not submitted within the deadline

If the statute of limitations is 7 years

If the intent to evade tax is discovered at the stage of filing a tax return

Therefore, if a large amount of income is undeclared, it may be taxable for up to 7 years.

I think it's okay if you don't find out.For what reason do you get caught?

Even if you think it's okay, you will find out.

An adult is someone who pays taxes.